Credit Collection Services (CCS) provides essential support for businesses facing debt recovery challenges. Their dedicated phone number allows for direct communication regarding accounts receivable management. Clients can also reach out via email for written inquiries. Understanding how to effectively engage with CCS is crucial for resolving outstanding debts. Exploring the best practices for this communication can lead to more effective solutions for financial concerns.

Overview of Credit Collection Services

Credit Collection Services (CCS) operates as a prominent agency specializing in debt recovery and accounts receivable management.

With a focus on providing efficient financial services, CCS aids businesses in reclaiming outstanding debts while ensuring compliance with regulations.

Their expertise enables clients to navigate the complexities of debt recovery, fostering a sense of financial freedom and stability for both creditors and debtors alike.

How to Contact Credit Collection Services

To reach Credit Collection Services, individuals and businesses can utilize several communication channels to ensure their inquiries are addressed promptly.

The company offers various contact methods, including phone and email, allowing for efficient access to customer support.

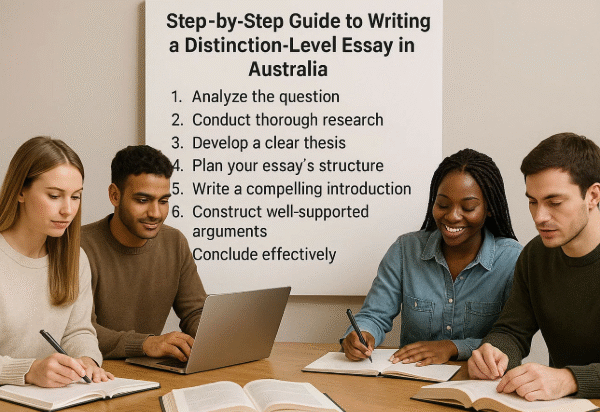

Tips for Communicating With Collection Agencies

Effective communication with collection agencies is crucial for individuals seeking to resolve their debts.

Employing effective negotiation strategies can help in reaching favorable outcomes. Consumers should be aware of their rights, ensuring they are treated fairly throughout the process.

Document all interactions and remain calm and respectful, which can facilitate more productive discussions and potentially lead to better repayment terms.

Conclusion

In summary, Credit Collection Services provides essential support for businesses navigating debt recovery. With various communication options, including a dedicated phone line and email, clients can easily access tailored solutions. Notably, research indicates that effective communication with collection agencies can increase recovery rates by up to 30%. This highlights the importance of utilizing the available resources and strategies to resolve outstanding debts efficiently and professionally, ensuring improved financial management for businesses.